US Bitcoin ETFs: Understanding fair value

Bitcoin Exchange-Traded Funds (ETFs) are live in the United States! As anticipated, the Security and Exchange Commission approved 11 products to start trading on regulated exchanges. Investors are excited! But are they going to get a fair price? ETF launches have interesting dynamics, and in this post we'll look at how some of them materialized.

ETF trading dynamics, the secondary market

A primary market is when investors buy securities directly from the issuer, and not from other investors. An Initial Public Offering (IPO) is one such example, where the funds raised go to the company in exchange for initial share. There are then secondary markets.

The secondary market is the most intuitive. Shares of a stock like AAPL

typically trade only on the secondary market. After shares are issued, they

change hands on a secondary market such as a stock exchange. Just like stocks,

ETFs trade on the secondary market. Unlike stocks, ETF shares also trade on the

'primary' market, which we'll explain further into this post.

ETF issuers typically contract market-makers to enrich the secondary market. Market-makers post executable quotes most of the time in the ETF orderbook, so that it is liquid.

This liquidity makes the product more attractive to investors as they know they can execute against these quotes to enter and exit a position. In other words: They will avoid a situation where there is no one to buy their ETF if they need to liquidate for whatever reason.

Considering only the existence of a secondary market for the moment, we can see that a market-maker is constantly posting quotes with a fixed spread. But what if everyone was selling to the market-maker?

In that case, they would sometimes offset/shift/fade (terminology varies by desk) their prices. The more they buy, the lower their bid and ask will be. This is both as a measure to mitigate concentration risk, or buying a lot of the same thing, and to mitigate inventory.

Consequently, the ETF may trade away from its fair value as a result of market pressure. In the case of Bitcoin ETFs, we can imagine that most people would be buying on the first day, and so the question becomes: Is there any particular, observable skew on launch day?

To determine this, we first need to calculate the theoretical ETF value. We'll be using Grafana to visualize the dataset in this tutorial. Feel free to follow our tutorial or visit the Grafana docs to set it up before proceeding.

Pricing fair value of an ETF

At the core, most ETFs represent a basket of assets. The price of such an ETF should be equal to the cost of replicating the basket. For example, buying the individual constituents should be equal to the cost of buying the index.

In this case, the basket for IBIT according to the issuer's website on Jan 11 close is worth 24.94 (Net Asset Value) with a spot on BTC-USD of 43,770.04. Further, the issuer posted that the fund contains 99.99% of BTC, and 0.01% of cash.

Therefore, we can price the ETF synthetically as follows:

SELECTtimestamp,price * 24.94 * (1 / 43770.04 * 0.9999 + 0.0001) AS IBIT_IMPLIED_FROM_BTCUSDFROMtradesWHERE$__timeFilter(timestamp)AND symbol = 'BTCUSD'

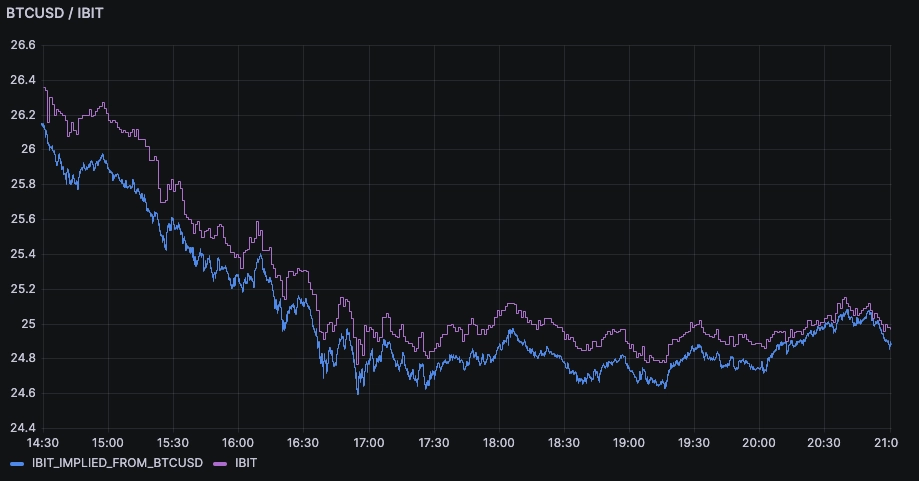

This gives us the following fair value as implied from the price on BTC-USD, as traded on Coinbase. We can also superimpose the price of IBIT directly and see that they are quite close and correlated, as expected:

We can generalize this concept to ETFs with more constituents. Their fair value can be calculated as a sum-product of the quantities + weights and the realtime asset prices.

Explaining the concepts of Premium and Discount

Shares of stock exist in a relatively static amount. While companies can issue more stock, and some events such as convertible bonds or warrants can result in stock issuance, external participants don't have control on the number of shares. After all, the number of shares is not meant to change every day.

In practical terms, this means that if someone sells a share of Company XYZ, then they need to source this physical share. They do so either by buying it from someone else or by borrowing it. Their ability to do so depends on:

- The general availability of shares - are there many in existence?

- The float - are there enough people willing to sell their shares, or are the holders keeping them?

This is also the case for many funds such as mutual funds. Since the number of existing shares for Fund ABC is not totally variable, one must find a willing seller to be able to purchase such share. And of course, a willing buyer to sell it. Consequently, shares of a mutual fund can sometimes trade far off of their fair value.

If there are more buyers than sellers, then the market price can be higher than the fair value. In this case, the fund is said to trade at a 'Premium'. If there are more sellers than buyers, the market may trade at a 'Discount' to the fair value.

The level of Premium and Discount can be calculated by comparing the level at which shares of the fund are trading to the official Net Asset Value which is calculated based on the assets it holds:

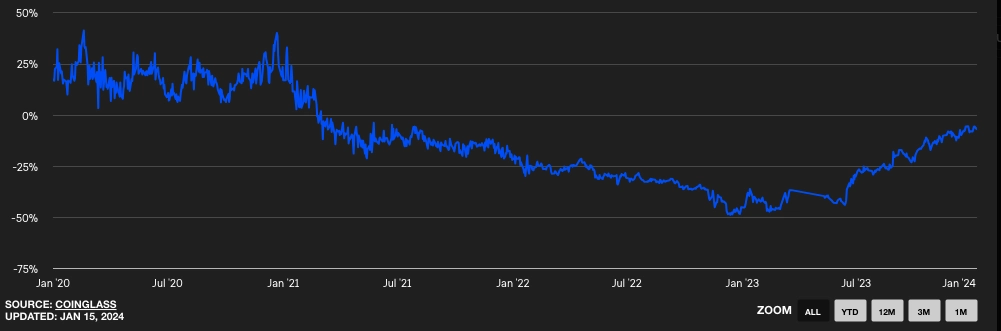

The Grayscale Bitcoin Trust, before it recently became an ETF, was subject to such fluctuations. In 2020, many market participants wanted to buy the fund to gain exposure to Bitcoin. However, there was a long delay in creating new shares of the fund. The Premium reached nearly 40%, which meant that one would buy the fund at a price 40% higher than the value of the assets it contained. Not a good deal.

Following the lending bankruptcies in 2021, the fund started trading at a deep discount reaching nearly 50%. This was mainly because selling the fund required finding a buyer, and there was no way to 'turn the fund back into Bitcoin' and sell the Bitcoin. In other words, once they bought the fund, investors were locked in until they could find a buyer at an acceptable price, or until the fund was approved to trade as an ETF.

As the ETF conversion became more likely, the discount converged back to zero:

ETF trading dynamics, exploring the primary market

Unlike shares of stocks and mutual funds, ETFs have a Creation/Redemption mechanism. Such a mechanism is designed to make it easy to issue and destroy shares of the fund. As a result, this greatly reduces the Premium and Discount.

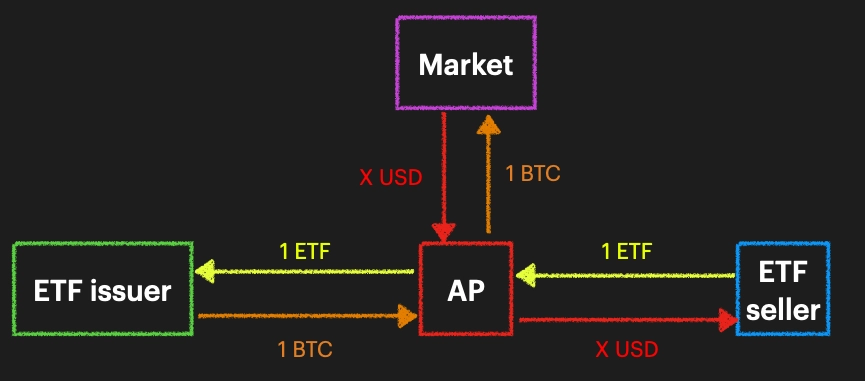

The redemption mechanism works as follows:

-

Someone sells 1 share of the ETF to a market-maker

-

The market maker is now long 1 ETF share. Since they don't want the market risk, they sell 1 BTC against it, and are then 'hedged'

-

The market-maker is an "Authorized Participant" (AP), which means they are allowed to create and redeem shares of the ETF directly with the ETF issuer

-

The AP contacts the issuer to redeem shares of the ETF as follows:

- AP gives 1 share of the ETF to the issuer

- Issuer gives the underlying assets to the AP (e.g. 1BTC) and 'destroys' the ETF share

This is a "risk-less'"transaction. The issuer and the AP exchange 1 share representing 1 BTC against 1 BTC at the same time. Since the AP received 1 BTC from the issuer, they covered the short they initiated to hedge their position initially.

The flows are highlighted below, and all cash flows equalize. Though keep in

mind that generally the ETF seller would receive a little bit less than X to

account for the spread:

This is Redemption. The Creation process is analogous but reverses the sides of all transactions. In practice, the AP window to create and redeem has a little more friction than described above. There are also fees associated.

Sometimes there is a fixed fee per creation/redemption, sometimes it is a variable fee as a percentage of the transaction value. Sometimes it's a combination of both. There is also a minimum size which means you can't do it for one share but rather, as an example, for 10,000 shares.

Calculating Bitcoin ETF Premium and Discount

We can use the above prices to derive the intra-day Premium and Discount with an ASOF JOIN of our theoretical price against the observed market price:

WITHimplied AS (SELECTtimestamp,price * 0.000569739 + 0.002494 AS IBIT_IMPLIED_FROM_BTCUSDFROMBTCUSDWHERE$__timeFilter(timestamp)),actual AS (SELECTtimestamp,price AS IBITFROMIBITETFWHERE$__timeFilter(timestamp))SELECTimplied.timestamp,last((IBIT / IBIT_IMPLIED_FROM_BTCUSD - 1) * 10000) AS premiumFROMimplied ASOF JOIN actual SAMPLE BY 30s

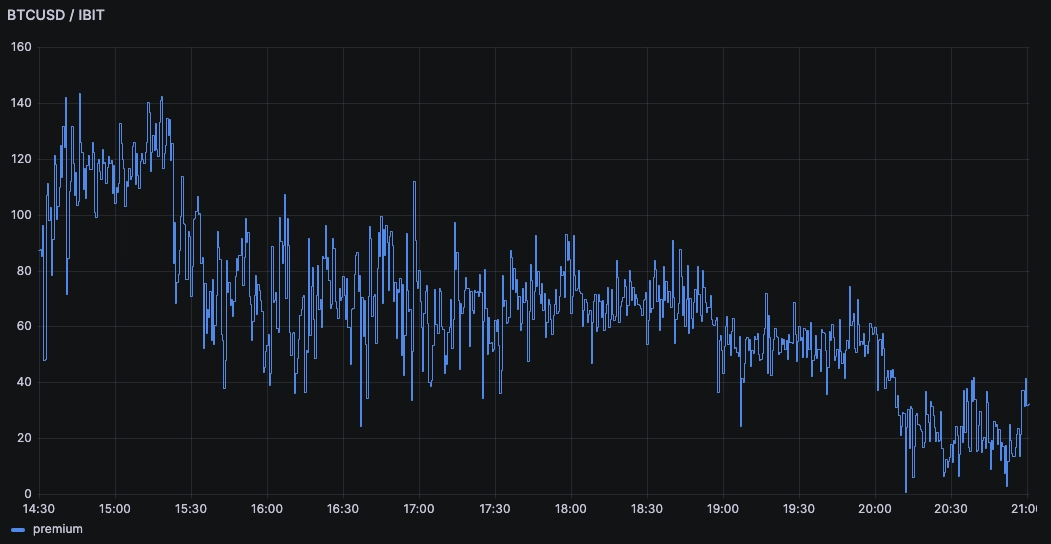

The result on the 12th of Jan is as follows:

It appears that there was a significant premium at the start of day (~1%) which then gradually reduced as the day went on. Part of this could be because BTC-USD dropped by more than 6% during the day. We can generalize this approach and apply it to other funds such as BITC:

Explaining the Premium and Discount

As previously mentioned, market-makers are paid to provide executable quotes with a maximum spread, over a minimum size. For example, this could be a minimum size of $100,000 for 95% of the time, with a maximum spread on 0.5%.

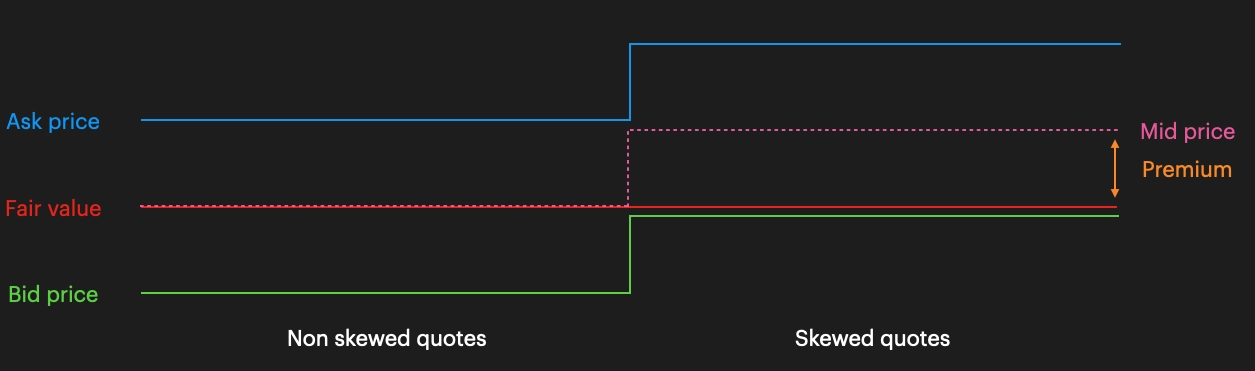

On launch day, you can witness very directional flows. It's more likely that investors will buy the fund than that they will sell it. Given this, a market-maker can anticipate that, say, 90% of trades will be investors buying, and 10% selling. One can skew their prices to maximize value out of this:

| Skew | Bid | Ask | Spread | Buy trades (10%) | Sell trades (90%) | Spread earned (Buy) | Spread earned (Sell) | Total | |

|---|---|---|---|---|---|---|---|---|---|

| Scenario 1 | 0 | 99.75 | 100.25 | 0.5 | 100 | 900 | $125 | $125 | $250 |

| Scenario 2 | 0.25 | 100 | 100.50 | 0.5 | 100 | 900 | 0 | $450 | $450 |

On a day where flow are anticipated to be very imbalanced, there is a strong incentive to skew prices while keeping the spread constant. This is because it maximizes market-making earnings.

We suspect this could be why we saw Premiums as high as 1.4% on the day. Here is how skewed and unskewed quotes would look relative to fair value, resulting into a Premium:

Although we said that the Creation/Redemption arbitrage should prevent large Premiums and Discounts, the mechanism is not completely perfect. For example:

- The minimum size for Creation and Redemption is generally quite large

- The Creation/Redemption can have costs. The Premium or Discount needs to be significant enough to cover such costs

- While the mid is significantly higher than fair value, an arbitrageur would need to sell the ETF into the market at the Bid price to complete the arbitrage. The bid is lower than the mid because of the spread, and may not be far enough above fair value to make the arbitrage viable

There are other situations where such Discounts and Premiums can occur as a result of market-makers shifting their quotes:

-

Existing risk: If a market-maker is short an ETF, or other ETFs with the same risk profile, they may choose to bid higher. As a result, they may offer higher as they maintain the spread constant to encourage people to sell to them and discourage them from buying to keep their risk under control.

-

Inventory management: If the market-maker is short an ETF for a small size, they may skew their prices to incentivize participants to sell to them to close their short. They do so because it would be cheaper and more practical than having to go through the primary market.

-

Flow management: A burst of buy orders after the fund appeared on television and a popular stream.

Summary, check Premiums before you trade!

Hopefully with this post you have a solid grasp on the concepts of Creation/Redemption and Premium/Discount for ETFs. You can use this knowledge combined with your own market data and the holdings published by the issuers to calculate your own fair values.

Most ETFs should trade close to such fair value. However, transient situations can occur and result in a significant deviation. By arming yourself with your own tools, you can avoid losing on trades by buying / selling 1% away from the 'true' price.

While some ETFs can trade at Premium and Discount for a sustained period, chances are the deviation is temporary and will be reduced shortly. Either way, when buying or selling an ETF, it should be your right to know if you're getting a fair price and you have all the information and tools at your fingertips!