Crypto Volume Profiles with QuestDB and Julia

When is the Bitcoin market most active and how does this activity change throughout the day? This is an important question to answer for any algorithmic trading strategy as it is more expensive to trade in low volume (illiquid) times and this could end up costing you money. In this post, I'll use QuestDB and Julia to calculate the average intraday volume profile which will show us how the pattern of trading varies throughout the day.

Environment

I'm using QuestDB version 6.2 and Julia version 1.7. I've installed the following packages from the Julia general repository.

using LibPQusing DataFrames, DataFramesMetausing PlotThemesusing Plotsusing Dates

For more information about getting setup with QuestDB read their get started with QuestDB guide.

Contents

- Importing CSV's into QuestDB

- Bitcoin daily volume trends

- Bitcoin intraday volume profiles

- Smoothing the volume profiles with LOESS

Importing CSVs into QuestDB via Julia

I've written before about connecting a data source to QuestDB in real-time and building you own crypto trade database. Now I will take a different approach and show you how to use QuestDB with csv files. This involves connecting to QuestDB using the REST API and passing the file with a corresponding database schema.

As most of us have our data in CSVs, (despite the flaws) this will hopefully help you build Bitcoin volume curves using Julia and QuestDB to better understand the flow of trading throughout the day. ove to a more practical database solution. I spent most of my Ph.D. wrestling with flat files and could have saved some time by moving to a database sooner.

In my case, I have a folder of CSV files of BTCUSD trades downloaded from Alpaca Markets (using AlpacaMarkets.jl) and iterate through them to upload to QuestDB.

For the schema, we tell QuestDB what the column the time stamp is (t in our

case) and the format of the time string. Alpaca provides microseconds so that is

translated into yyyy-MM-ddTHH:mm:ss.SSSUUUZ. We then define what columns are

symbols.

What's a symbol? Well in our case it is a type of string that is constant in a

column. Some people call them enums, you might also call them factors. Symbol

values can only be set few values. So for our data, the exchanges (column x)

are one of three values, therefore suited as a symbol.

For each file, we simply open and post to our localhost at port 9000 where QuestDB is running.

using HTTP, JSONconst host = "http://localhost:9000"function run()SCHEMA = [Dict("name"=>"t", "type"=>"TIMESTAMP", "pattern" => "yyyy-MM-ddTHH:mm:ss.SSSUUUZ"),Dict("name" => "symbol", "type" => "SYMBOL"),Dict("name" => "x", "type" => "SYMBOL"),Dict("name" => "tks", "type" => "SYMBOL")]SCHEMA_JSON = JSON.json(SCHEMA)for (root, dirs, files) in walkdir("../data/trades/ETHUSD")for file in filesfl = joinpath(root, file)println(fl)csvfile = open(fl)body = HTTP.Form(["schema" => SCHEMA_JSON, "data" => csvfile])HTTP.post(host * "/imp?name=alpaca_crypto_trades&overwrite=false×tamp=t&partitionBy=DAY", [], body; verbose = 2)close(csvfile)endendend

Let's take a look at the post command in detail:

HTTP.post(host * "/imp?name=alpaca_crypto_trades&

overwrite=false&

timestamp=t&

partitionBy=DAY",

[], body; verbose = 2)

We split this out into the different parameters:

name=alpaca_crypto_trades: the name of the table where we are writing the data.overwrite=false: With each data file don't overwrite the existing table, append the data to the table.timestamp=t: This is the designated timestamp. This is the key column in the data as our operations all depends on this timestamp. In our case, it is the time at which the trade occurred, so if we want to aggregate the data to say hourly or even days this is the column QuestDB needs to work with.partitionBy=DAY: We have lots of data and want QuestDB to operate as efficiently as possible. By partitioning the data we store each day as a separate file which means faster read times and better performance. In our case, partitioning by each day is a sensible choice as our questions are likely to be around daily statistics, (average daily volume, average daily distribution). For a different application, say sensor data, you might find a different partitioning interval works better.

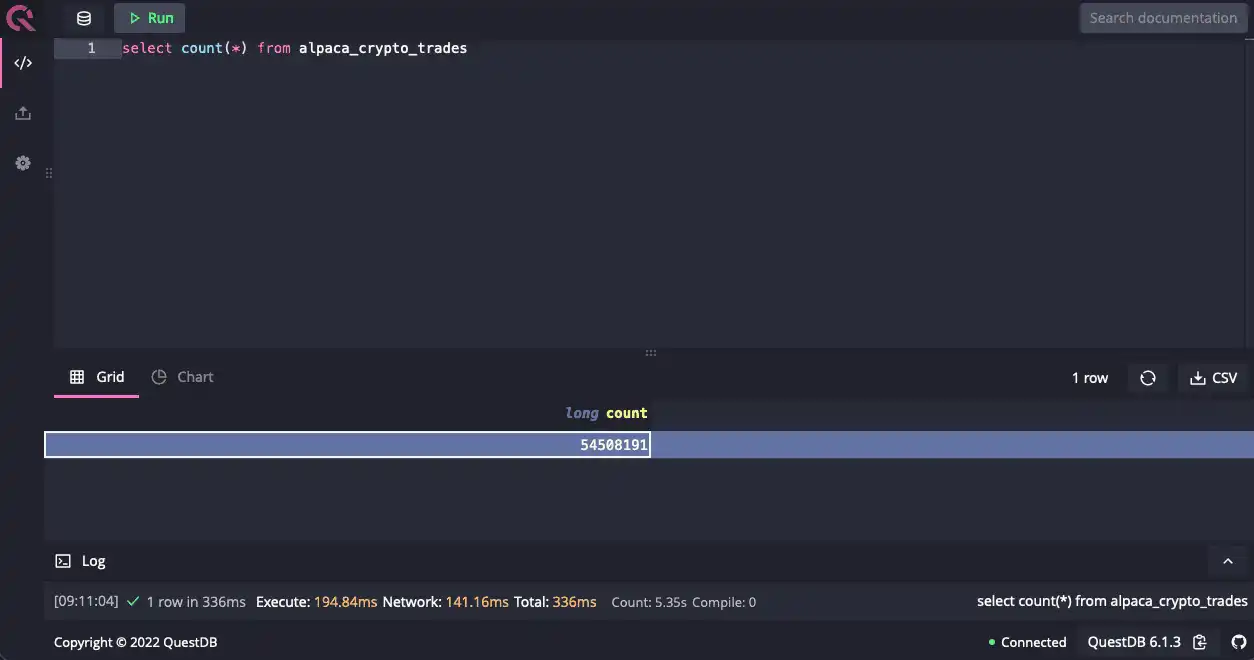

We iterate through all the different files and receive a message telling us whether the file was successfully uploaded. We can go to the web GUI and check to make sure everything worked by counting the number of rows.

Now let's connect to the database in Julia and see if we get the same result.

conn() = LibPQ.Connection("""dbname=qdbhost=127.0.0.1password=questport=8812user=admin""")execute(conn(), "SELECT count(*) FROM alpaca_crypto_trades") |> DataFrame

| count |

|---|

| 54508191 |

The same as the above screenshot. Our import method runs without a hitch so now let's do some finance.

Bitcoin daily volume trends

Bitcoin has been having a tough time recently. Everyone is back to school or their jobs and doesn't have time to day-trade cryptocurrencies anymore. Central banks are raising rates, economies are about to start their 'post' COVID period and so many other macro factors are leading us into a new asset regime. How has this changed the number of daily trades and also the total amount of traded dollar volume each day in Bitcoin?

This type of query is where QuestDB shines and we can answer with some simple code. We have partitioned our table by day and thus it can iterate through each day, summing the amount of volume and the total number of trades to come up with our daily summaries.

dailyVolume = execute(conn(),"SELECT t, symbol, sum(s), count(*) FROM alpaca_crypto_tradesSAMPLE by 1dGROUP BY symbol, t") |> DataFramedropmissing!(dailyVolume);first(dailyVolume, 4)

| t | symbol | sum | count | |

|---|---|---|---|---|

| 1 | 2021-10-23T00:00:00.098 | BTCUSD | 6721.99 | 293601 |

| 2 | 2021-10-24T00:00:00.098 | BTCUSD | 8420.77 | 369846 |

| 3 | 2021-10-25T00:00:00.098 | BTCUSD | 10167.0 | 383259 |

| 4 | 2021-10-26T00:00:00.098 | BTCUSD | 10122.0 | 397424 |

Which we then plot as both the total volume per day and the total number of trades per day.

ticks = minimum(dailyVolume.t):Day(60):maximum(dailyVolume.t)tick_labels = Dates.format.(ticks, "dd-mm-yyyy")vPlot = plot(dailyVolume.t, dailyVolume.sum, label = "Notional Volume", xticks = (ticks, tick_labels))nPlot = plot(dailyVolume.t, dailyVolume.count, label = "Total Trades", xticks = (ticks, tick_labels))plot(vPlot, nPlot)

Both the total notional traded and the total number of daily trades dropped off around Christmas time, which is to be expected. We are all too busy feasting on turkey to be trading Bitcoin! But so far in 2022, the daily notional has remained subdued whereas the number of daily trades has picked up which indicates there are more people trading but only smaller amounts. Now given the absolute rout in Bitcoin's price so far in 2022 (-20% so far) this is could indicate it is mainly small participants selling the smaller holdings.

plot(dailyVolume.t, dailyVolume.sum ./ dailyVolume.count, label = "Average Trade Size")

Dividing the average daily notional by the total number of daily trades shows this steady reduction in the average trade size.

We have an idea of how much is traded every day, but how is this distributed throughout the day? Anyone trading frequently or trading with lots of volumes will want to be trading when everyone else is to make sure they are getting the best prices and not just pushing the price around.

How do we calculate these volume profiles and more importantly, how do we calculate these profiles efficiently? QuestDB to the rescue!

Bitcoin intraday volume profiles

For each hour and minute of the day, we want to calculate the total amount traded. We then want to divide this by the total amount traded over the full sample to arrive at a percentage. This will then give us the fraction of the total volume traded aka the volume profile of a given day.

To make our life easier we create a volume_minute table that aggregates the

raw market data into minute frequencies.

execute(conn(),"CREATE TABLE volume_minuteAS(SELECT t, avg(p) as avg_price, avg(s) as avg_size, sum(s) as total_sizeFROM alpaca_crypto_tradesWHERE t >'2021-11-08'SAMPLE BY 1m)")

This is exploiting the full power of QuestDB. Using the SAMPLE BY function we

can reduce our raw data into 1-minute subsamples that each has the total amount

traded in that one minute. This function will create a new table called

volume_minute which we can use for the rest of our analysis.

We can now aggregate this over the hour and minute of the day to arrive at our profile of volumes over a given day. We want to know the total amount trade in our data set for each minute.

intraVolume = execute(conn(), "SELECT hour(t), minute(t), sum(total_size)FROM volume_minuteGROUP BY hour(t), minute(t)" ) |>DataFrame |> dropmissing;totalVolume = execute(conn(),"SELECT sum(total_size) from volume_minute") |> DataFrame |> dropmissing;

Once those have been calculated in QuestDB we pull them into Julia and calculate the fraction of the volume traded at each hour and minute.

intraVolume = @transform(intraVolume,:ts = DateTime(today()) + Hour.(:hour) + Minute.(:minute),:frac = :sum ./ totalVolume.sum);

Like everything in life, a graph is better than a table.

ticks = minimum(intraVolume.ts):Hour(2):maximum(intraVolume.ts)tick_labels = Dates.format.(ticks, "HH:MM")plot(intraVolume.ts, intraVolume.frac,xticks = (ticks, tick_labels), seriestype = :scatter, label=:none, ylabel="Fraction of Volume Traded")

This looks great, we see trading is at the lowest at 10:00 but peaks at 16:00. It is very noisy though.

We can also think in terms of how much is left to trade at a given time of day. So as the clock turns midnight we have 100% of the day's volume to trade. This is equivalent to calculating the cumulative proportion.

plot(intraVolume.ts, 1 .- cumsum(intraVolume.frac), xticks = (ticks, tick_labels),label = "How much is left to trade in the day?",ylabel = "Fraction of Total Volume Remaining")

So we can see that by 06:00 there is roughly still 75% of the day's volume to trade. By 18:00 just over 25% left. So from our earlier analysis of how much daily volume is roughly traded, we can start predicting how much volume is left to trade over a day when we log into our broker.

As Bitcoin crypto markets are unique as they trade over the weekends. So we should split these volume curves up into the day of the week and see how they look.

Bitcoin volume profiles for each weekday

This is as simple as adding an extra clause to the GROUP BY statement to add

the day of the week. Again, we repeat the same process as before.

dowLabel = DataFrame(day_of_week = 1:7,day_of_week_label = ["Mon", "Tue", "Wed","Thur", "Fri", "Sat", "Sun"]);intraVolume_day_req = async_execute(conn(),"SELECT day_of_week(t), hour(t), minute(t), sum(total_size) FROM volume_minute GROUP BY day_of_week(t), hour(t), minute(t)")intraVolume_day = fetch(intraVolume_day_req) |> DataFrame |> dropmissing;totalVolume_day = execute(conn(),"SELECT day_of_week(t), sum(total_size) from volume_minute GROUP BY day_of_week(t)") |> DataFrame |> dropmissingrename!(totalVolume_day, ["day_of_week", "total_daily_volume"])totalVolume_day = leftjoin(totalVolume_day, dowLabel, on = "day_of_week")intraVolume_day = leftjoin(intraVolume_day, totalVolume_day, on="day_of_week");

This gives us the total volume at each minute and hour per weekday, plus the total amount traded for that weekday in the period too.

intraVolume_day = @transform(intraVolume_day,:ts = DateTime(today()) + Hour.(:hour) + Minute.(:minute),:Volume_Frac = :sum ./ :total_daily_volume);sort!(intraVolume_day, :day_of_week)first(intraVolume_day, 4)

| hour | minute | sum | total_daily_volume | day_of_week_label | ts |

|---|---|---|---|---|---|

| 0 | 0 | 369.729 | 3.11011e5 | Mon | 2022-03-09T00:00:00 |

| 0 | 1 | 249.165 | 3.11011e5 | Mon | 2022-03-09T00:01:00 |

| 0 | 2 | 589.069 | 3.11011e5 | Mon | 2022-03-09T00:02:00 |

| 0 | 3 | 265.611 | 3.11011e5 | Mon | 2022-03-09T00:03:00 |

Plotting this gives us the intraday volume profile for each day of the week.

plot(intraVolume_day.ts,intraVolume_day.Volume_Frac,group=intraVolume_day.day_of_week_label,xticks = (ticks, tick_labels),ylabel="Fraction of Volume Traded")

Very noisy! We can sort of see the general increase of volume at 16:00 similar to the single curve above. Comparing the weekdays becomes a bit easier when we look at how left is left to trade at each time.

gdata = groupby(intraVolume_day, :day_of_week)intraVolume_day = @transform(gdata, :CumVolume = cumsum(:Volume_Frac));plot(intraVolume_day.ts,1 .- intraVolume_day.CumVolume,group=intraVolume_day.day_of_week_label,legend = :topright, xticks = (ticks, tick_labels),ylabel = "Fraction of Total Volume Remaining")

Saturday is the day that strays away from all the others. This shows that the profile of trading BTCUSD over Saturday is structurally different to the other weekdays. So if you are running an algorithmic trading strategy 24 hours 7 days a week then you will need to consider how Saturday might need some special rules.

Smoothing the volume profiles with LOESS

The next step is to smooth these curves out. We want to remove the noise so we can better understand the underlying shape of the volume traded. Plus if this type of data was feeding into an algorithmic trading strategy we wouldn't want the jitter of the data to influence the trading data.

We are going to use LOESS (locally estimated scatterplot smoothing) which takes the points and looks at the nearest neighbours to come up with a value that is a rough average. It then moves along to the next point and repeats the process. There is a free parameter that controls how far ahead and behind it looks to calculate the average which we will set to 0.15.

This is all implemented in the Loess.jl package, so you don't need to worry about what is happening, we can just use the function.

using Loessmodel = loess(1:nrow(intraVolume), intraVolume.frac, span=0.15)vs = Loess.predict(model, Float64.(1:nrow(intraVolume)))smoothPlot = plot(intraVolume.ts, intraVolume.frac, xticks = (ticks, tick_labels), label = "Raw")plot!(smoothPlot, intraVolume.ts, vs, label = "LOESS - 0.15", linewidth=3)

This smoothed curve produces a sensible-looking approximation to the raw data and removes much of the noise. The curve is a more sensible input into an algorithmic trading model instead of the raw data. If we look around 14:00 we can see that there is a large spike in the raw volume, whereas the LOESS curve smoothes this out. If our trading model was using the raw data it might expect a surge in volume at 14:00 all the time and start trading accordingly, whereas in reality, we are confident that is just noise and our smoothed profile is more reliable.

However, there is a major point to consider when using LOESS as a smoothing method. As it looks at a local neighbourhood of points, it is looking into the future to smooth a value in the past. If we were using these values to predict something, this would be a big no-no as we are using the information in the future to predict the past. But for this application, it is ok. We are only trying to understand the shape of the curves and not predict future values, therefore so long as we bear what LOESS is doing in mind, we can safely use it to smooth out our volume numbers. So we wouldn't be able to use LOESS in real-time to smooth the market volumes as it requires points from the future.

With all that considered now let's apply it to the rest of our weekdays.

Let's write a function that does the smoothing and apply it to each different day of the week.

function loess_smooth(x; smooth=0.5)model = loess(eachindex(x), x, span=smooth)Loess.predict(model, Float64.(eachindex(x)))end

Applying this to each weekday using the groupby functions on the data frame.

gdata = groupby(intraVolume_day, :day_of_week)intraVolume_day = @transform(gdata, :SmoothVolume = loess_smooth(:Volume_Frac));sort!(intraVolume_day, :day_of_week)dropmissing!(intraVolume_day);weekdays = @subset(intraVolume_day, :day_of_week .<= 5)weekends = @subset(intraVolume_day, :day_of_week .> 5);

I've added an indicator if it is a weekday or weekend for easy separation.

ticks = minimum(intraVolume.ts):Hour(6):maximum(intraVolume.ts)tick_labels = Dates.format.(ticks, "HH:MM")weekdayPlot = plot(weekdays.ts,weekdays.SmoothVolume,group=weekdays.day_of_week_label,xticks = (ticks, tick_labels),legend = :bottomright)weekendPlot = plot(weekends.ts,weekends.SmoothVolume,group=weekends.day_of_week_label,xticks = (ticks, tick_labels),legend = :bottomright)plot(weekdayPlot, weekendPlot)

Much more interpretable! The smoothed curves make it easier to see some interesting features:

- Wednesday and Thursday have a second peak of trading at about 19:00.

- Mondays and Fridays have the highest peaks at 16:00.

- The weekend is flatter in activity, the peaks are smaller.

- Sunday trading starts increasing earlier and then carries on as it moves into Monday morning.

- Saturday follows the more typical pattern with an interesting increase at 06:00.

Conclusion

The power of QuestDB shows how easy and quick it is to gain intuition around where the most active periods of Bitcoin trading happen throughout the day. We've shown how average daily volumes and number of trades has fallen in recent months which has also led to a smaller average trade size in the same period.

Once we looked at the average profile over the day we found that the peak volumes are in the afternoon from about 15:00 onwards, coinciding with America waking up and trading.

Finally, we then found that weekends have a less extreme profile than weekdays and more interestingly that Sundays trading continues in the late hours as the working week begins.

For an algorithmic trading system, you will use this information to adjust the strategy at different times of the day. A signal telling you to buy at 2 am in this illiquid period could end up costing you money if you trade too aggressively.

This post comes from Dean Markwick. If you like this content, we'd love to hear your thoughts! Feel free to try out QuestDB on GitHub or just come and say hello in the community forums.